Popular search engine company files for its eagerly anticipated initial public offering.

Google, the world's No. 1 Internet search engine, finally filed for its initial public stock offering Thursday and promised to maintain its long-term focus even though it will soon face the intense scrutiny of Wall Street. The company said in a filing with the Securities and Exchange Commission that it expects to raise as much as $2.7 billion from the offering, which it will conduct in the unusual format of an online auction in a bid to make its shares more widely available.

Company Mantra - "Do No Evil"

Google, founded in 1998 by former Stanford University students Sergey Brin and Larry Page, has quickly become one of the most successful Internet companies, thanks to search technology that many experts say is superior to offerings from rivals. (For more on the founders' stakes in Google and their pay, click here).

Eric Schmidt, the former CEO of Novell and chief technology officer at Sun Microsystems, joined Google as its chairman in March 2001 and was named CEO later that year.

The company has become not just a tech juggernaut but a popular culture phenomenon as well, with people using the verb "Googled" to describe searching for information on the site.

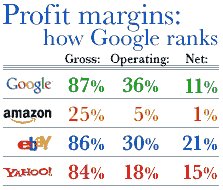

It probably makes the most sense to compare Google with Yahoo! since it is Google's main rival. Yahoo! reported net income of about $238 million last year and has a market value of about $36 billion. So it is valued at 151 times trailing net income.

Based on that multiple, Google's stock market value would be about $16 billion.

But Google would be worth more if you looked at a price to sales ratio. Yahoo! is valued at about 24.5 times 2003 revenues of about $1.47 billion.

Using that multiple, Google could have a market worth of about $24 billion!

Brin and Page pledged in their letter that they will not play the game of managing expectations, trying to meet quarterly earnings estimates just to appease Wall Street. The two even quoted legendary value investor Warren Buffett.

"In Warren Buffett's words, 'We won't "smooth" quarterly or annual results: If earnings figures are lumpy when they reach headquarters, they will be lumpy when they reach you'," the two wrote.

In addition, the offering is structured in a way so that Brin and Page will continue to have strong control of the company's fate. Brin and Page own nearly a third of the company's Class B stock, which has 10 times the voting power of the Class A shares to be sold in the public offering.

The auction process is fairly unique, particularly for a company of Google's stature.

But Google has a reputation of doing things differently, which should make for some interesting times once the company starts trading.

No comments:

Post a Comment